Investment bubbles occur not because people can’t spot the importance of a technology, but because they misunderstand the nuances of the market that provide it.

Last week, Nvidia published its blockbuster earnings. In the three months to January, revenue rose 265 per cent to $22.1bn, which was way ahead of analyst expectations. In the last year, Nvidia has become the most important stock in the world. It is a proxy for the development of AI and off the back of its results, the American and Japanese stock exchanges hit record highs.

When revolutionary technology has emerged, it has often caused a period of overvaluation. The arrival of the steam engine created ‘railway mania’ in the 1840s, while the invention of the internet at the end of the 20th Century stretched telecom stocks beyond reasonability.

It is not just fools that have been tricked by the promise. The UK railway companies in the 19th Century attracted investment from geniuses of the time Charles Darwin, the Brontë Sisters and John Stuart Mill. The problem was no one had any idea how much railway the UK would need. The dominant view among the railway bulls was the UK would need between 20,000 and 30,000 miles. However, by the 1850s just 4,000 miles had been constructed, the result was ruin for the shareholders. Even today, almost 200 years on there is only 20,000 miles across the country.

It was a similar story with the telecommunications companies. At the turn of the 21st Century, mobile telephone use was expanding rapidly, and the emergence of the internet had people excited about the unbounded possibilities of data transfer. The theory was we need a lot more infrastructure, including wireless towers and fibre optics cables.

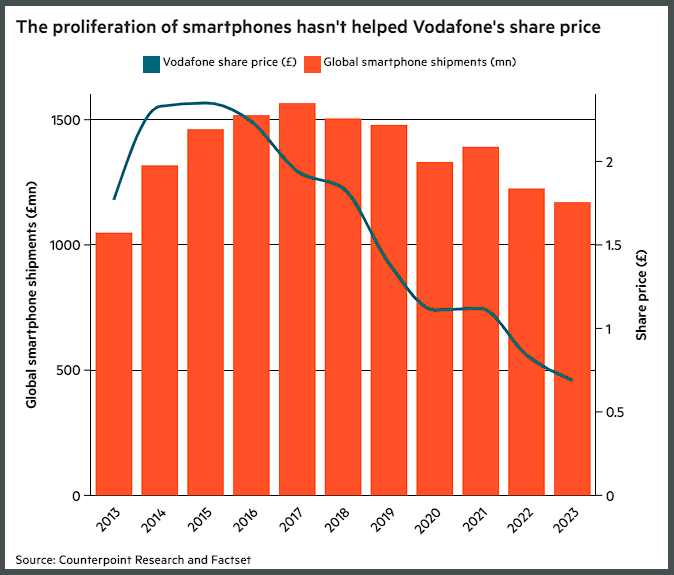

Correspondingly, Vodafone’s share price increased 200 per cent between 1998 and 2000. This was driven by valuation expansion with its forward price to earnings rising from 28 to 53. However, over the next five years, its share price dropped 70 per cent and it has never recovered. This is despite revenue expanding almost seven times from £4.5bn to £34bn.

The issue for Vodafone investors is that while they identified the importance of telephones and the rise of the internet, they misunderstood where in the market the value would be captured. Vodafone’s infrastructure build-out was costly and it needed to keep investing in R&D to stay ahead of its competitors, which kept margins consistently suppressed. Even today, Vodafone is still spending billions to build out the 5G network while being weighed down by the £41bn of net debt it has accumulated over the years.

It is not even just the investors that didn’t understand the telecommunications industry. T-Mobile’s takeover of Sprint in April 2020 attracted controversy. Yale economist and antitrust scholar Fiona Scott Morton believed this merger would reduce competition and allow T-Mobile, Verizon and AT&T to nestle into a ‘cozy triopoly’. “The era of aggressive price competition in wireless is over,” she wrote in a 2021 article.

Leave a Reply